Singapore allocates most residential land through a centralized planning system led by the state. This approach allows urban development to serve long-term economic stability, environmental control, and social order at the same time. Housing projects are rarely just buildings. They are signals of policy direction and fiscal discipline.

That reality is clear at Tengah Garden Residences, which rises within Singapore’s first planned Forest Town. The project sits inside Tengah New Town, a district designed from the ground up by public agencies to support green living, car-lite mobility, and efficient land use. Private development here follows a government blueprint that reflects political priorities before market trends.

Tengah’s location is not accidental. The area was released through the Government Land Sales program, a controlled process that allows the state to pace supply, manage prices, and guide urban growth. By deciding when and how land enters the market, policymakers influence investment flows and housing affordability. Developers operate within these boundaries, aligning business goals with national planning objectives.

Political Planning as Economic Policy

Urban planning in Singapore functions as an extension of economic policy. Agencies such as the Urban Redevelopment Authority and the Ministry of National Development coordinate land use, transport links, and environmental standards years ahead. Tengah reflects this approach through its integration with the Jurong Region Line, cycling networks, and centralized cooling systems designed to reduce energy use.

These features carry political weight. They demonstrate how the government frames sustainability as a practical investment rather than a slogan. Green design lowers long-term infrastructure costs and supports Singapore’s climate commitments. For residents and investors, it signals policy consistency, which reduces uncertainty and supports confidence in the property market.

Public Land, Private Capital

The balance between public control and private capital is a defining feature of Singapore’s real estate system. Land remains state-owned, while development rights are sold under strict conditions. This model limits speculation and ties financial returns to compliance with planning goals.

Within Tengah, developers respond to guidelines on building height, green coverage, and community spaces. These rules shape financial outcomes by influencing construction costs and buyer appeal. Over time, they help maintain stable property values and protect the broader housing ecosystem.

Projects like Tengah Garden Residences Singapore show how political decisions translate into financial structure. Pricing, density, and amenities reflect state-led priorities around liveability and long-term demand rather than short-term gains, which helps explain why real estate is a good investment even in tightly regulated markets like Singapore’s.

Urban Growth and Public Trust

Large-scale developments serve another role. They act as visible proof of governance. When planning delivers efficient transport, green spaces, and coherent neighborhoods, public trust grows. Tengah’s Forest Town concept supports this by promising cleaner air, quieter streets, and shared public spaces.

This trust matters in a dense city where land is scarce. Political legitimacy is reinforced when citizens see careful stewardship of limited resources. Housing policy becomes a social contract, linking economic growth with quality of life.

Messaging Through Design

Architecture and town planning communicate values. Tengah’s emphasis on smart systems and nature integration aligns with Singapore’s broader message of being future-ready. It positions the country as a place where policy, technology, and finance move together.

That message reaches investors as well. A clear planning narrative reduces risk and attracts long-term capital. Developments guided by consistent political logic tend to perform more steadily across market cycles.

Conclusion

Tengah Garden Residences ultimately represents more than a housing option. It reflects how Singapore uses urban development to express political intent, manage economic outcomes, and maintain public confidence. By aligning sustainability, fiscal planning, and controlled land release, projects like Tengah Garden Residences reveal how deeply politics and economics are woven into the city’s built environment.

More than 500,000 people in the United States rely on the Deferred Action for Childhood Arrivals (DACA) program to legally work and study. But every time political tides change, so does their financial stability. The DACA policy, first introduced in 2012, gave undocumented immigrants brought to the U.S. as children a chance to come out of the shadows. While it provided protection from deportation and work permits, it never offered permanent legal status. That limited protection continues to place DACA recipients at economic risk.

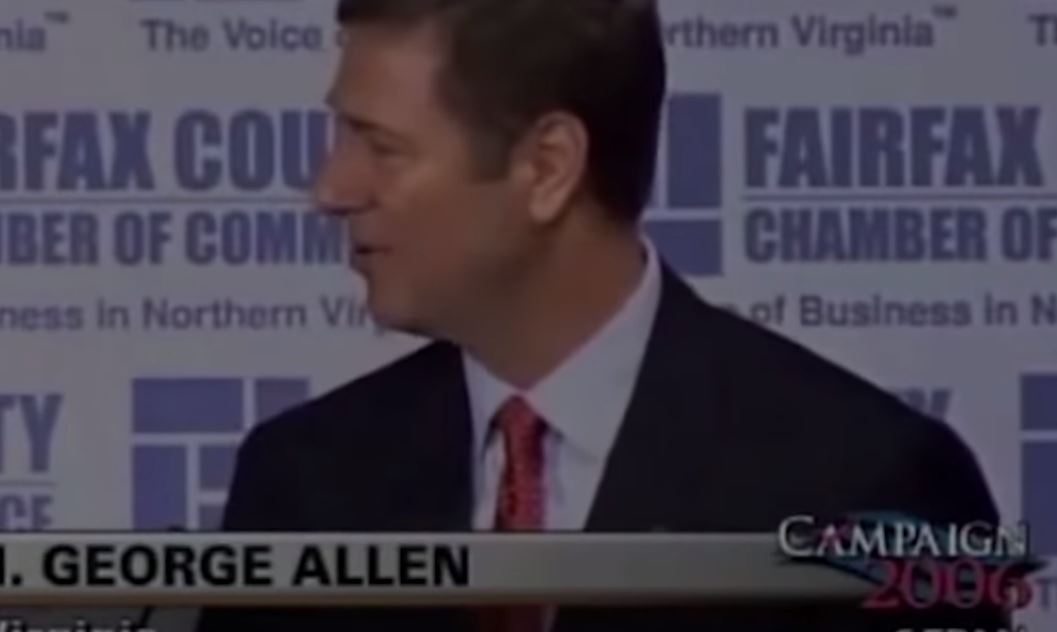

More than 500,000 people in the United States rely on the Deferred Action for Childhood Arrivals (DACA) program to legally work and study. But every time political tides change, so does their financial stability. The DACA policy, first introduced in 2012, gave undocumented immigrants brought to the U.S. as children a chance to come out of the shadows. While it provided protection from deportation and work permits, it never offered permanent legal status. That limited protection continues to place DACA recipients at economic risk. At the Republican Party’s convention in Milwaukee last Thursday, Donald Trump promised to lower taxes as well as revert to encouraging fossil fuel extraction. The forme US president still believes that the climate-related programs are scams. Apparently Trump believes that the only way to stop inflation tis by increasing the country’s production of fossil fuels, for which the Republican presidential nominee chanted “We drill, baby, dril.” Trump fueled the imagination of his supporters by telling them that the US has more liquid than any other country in the world.

At the Republican Party’s convention in Milwaukee last Thursday, Donald Trump promised to lower taxes as well as revert to encouraging fossil fuel extraction. The forme US president still believes that the climate-related programs are scams. Apparently Trump believes that the only way to stop inflation tis by increasing the country’s production of fossil fuels, for which the Republican presidential nominee chanted “We drill, baby, dril.” Trump fueled the imagination of his supporters by telling them that the US has more liquid than any other country in the world. Trump vows to put an end to the Democrats’ green

Trump vows to put an end to the Democrats’ green  everal legislators in Congress, coming from both political parties, are showing bipartisan support for new tax cut deals despite the country’s current record high national debt. Although the proposed legislation aims to help cash-strapped Americans and businesses, the bill is headed toward tough negotiations in the 2024 sessions.

everal legislators in Congress, coming from both political parties, are showing bipartisan support for new tax cut deals despite the country’s current record high national debt. Although the proposed legislation aims to help cash-strapped Americans and businesses, the bill is headed toward tough negotiations in the 2024 sessions. Republican lawmakers are pushing for the revival of three expired or phased out business tax credits the party introduced via a 2017 GOP-sponsored law. Yet sources say that negotiations for their

Republican lawmakers are pushing for the revival of three expired or phased out business tax credits the party introduced via a 2017 GOP-sponsored law. Yet sources say that negotiations for their  Last week, the upper House or the Senate passed the debt ceiling bill, which Republican lawmakers have vowed to block at the lower house. However, Republicans failed to do so as the bill passed the

Last week, the upper House or the Senate passed the debt ceiling bill, which Republican lawmakers have vowed to block at the lower house. However, Republicans failed to do so as the bill passed the  Upon reaching the Senate, the bill that allows Pres.

Upon reaching the Senate, the bill that allows Pres.

In 2024, India’s Unified Payments Interface (UPI) handled over 117 billion transactions worth more than $2 trillion. This digital marvel, born in Mumbai’s bustling fintech scene, now pulses through the veins of everyday life—from street vendors in Delhi to tech hubs in Bangalore. Picture a world where a simple QR code scan settles a bill in seconds, no cash needed. That’s UPI for you, a quiet revolution that has turned India into a global payments powerhouse.

In 2024, India’s Unified Payments Interface (UPI) handled over 117 billion transactions worth more than $2 trillion. This digital marvel, born in Mumbai’s bustling fintech scene, now pulses through the veins of everyday life—from street vendors in Delhi to tech hubs in Bangalore. Picture a world where a simple QR code scan settles a bill in seconds, no cash needed. That’s UPI for you, a quiet revolution that has turned India into a global payments powerhouse.

Politics and finance are deeply intertwined, with government policies having a significant impact on financial markets.

Politics and finance are deeply intertwined, with government policies having a significant impact on financial markets.

is an online learning resource where individuals learn important actions to take to start a business and toward achieving financial success. Online programs present different

is an online learning resource where individuals learn important actions to take to start a business and toward achieving financial success. Online programs present different  According to Reuters the country’s post pandemic economy in 2022 and 2023 grew by 7.2% after the government boosted capital investments. Yet the Reuters report also mentioned the fact that India is now the most populous nation in the world after overtaking China with a record of 1.4 billion people. The significance of which is that nearly 53% of that population are below 30 years old, and most of which are without jobs. As a result, tens of millions of jobless young people could end up dragging down India’s economy.

According to Reuters the country’s post pandemic economy in 2022 and 2023 grew by 7.2% after the government boosted capital investments. Yet the Reuters report also mentioned the fact that India is now the most populous nation in the world after overtaking China with a record of 1.4 billion people. The significance of which is that nearly 53% of that population are below 30 years old, and most of which are without jobs. As a result, tens of millions of jobless young people could end up dragging down India’s economy.